- Home

-

Services

-

Software Development

Innovative, future-proof software solutions

-

Ecommerce

Next-level solutions for B2B & B2C

-

Generative AI

Drive technological innovation

MAINTENANCE AND SUPPORT

DEVELOPMENT

CONSULTING

-

- Industries

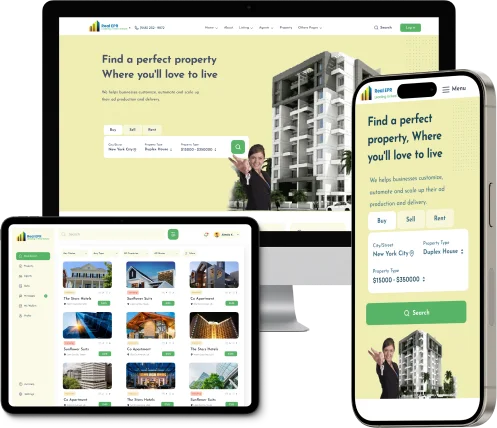

Real Estate

Innovating Tomorrow's Living Spaces

Tour & Travels

Journey Beyond Boundaries

Education

Transforming Learning Experiences

Transport

Optimizing Supply Chains

Event

Creating Impactful Experiences

Healthcare

Advancing Healthcare Tech

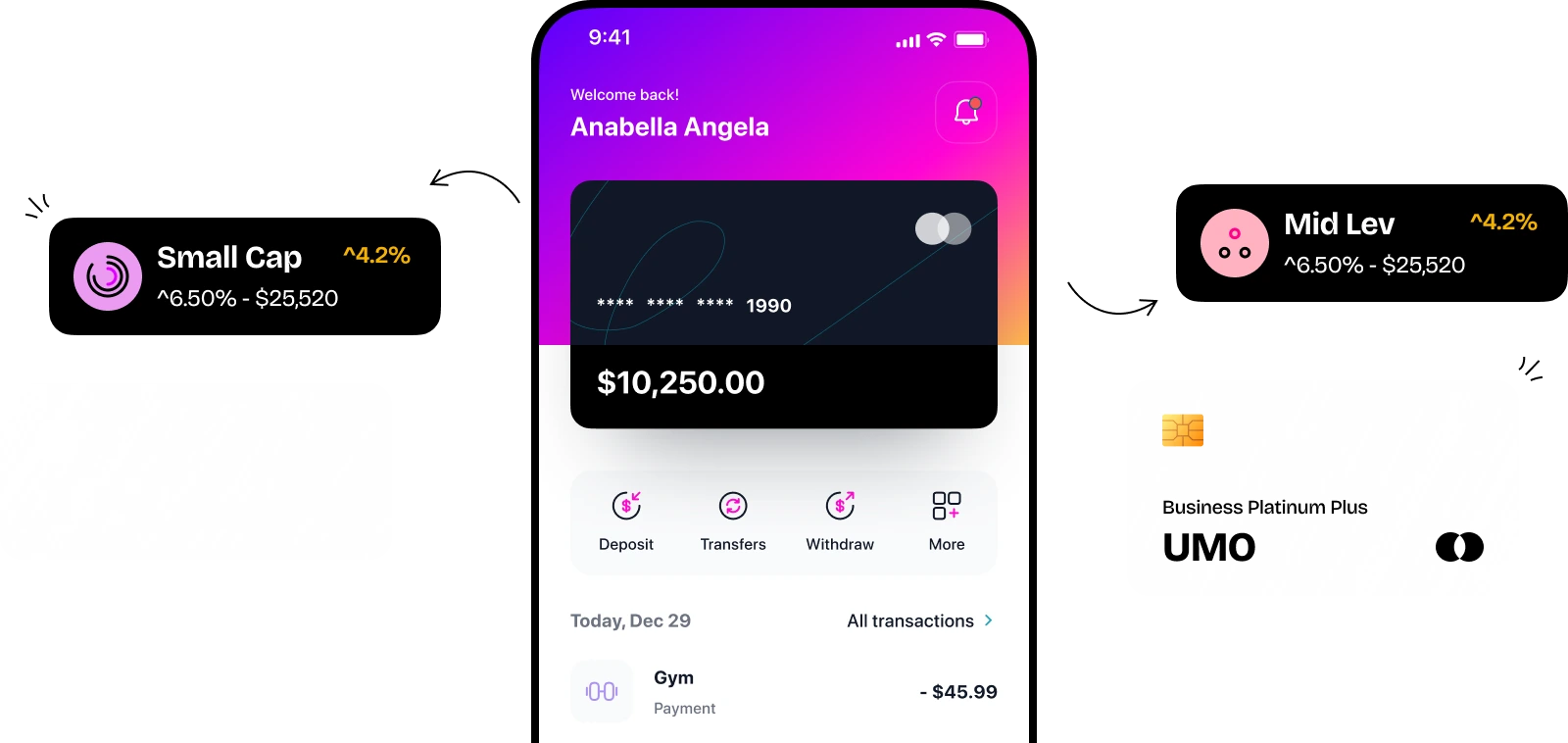

Finance

Revolutionizing Financial Services

Restaurant

Elevating Dining Experiences

On-Demand

On-Demand Software Solutions

- Careers

- About MCS